There are a few system features for dealing with Harmonized Sales Tax (HST) in Canada. A distributor is charged HST when product is purchased, and they collect HST when product is sold. Distributors need the ability to track tax payments and tax collections, so that they can remit the difference according to their filing requirements. To enable these features, check the “Use Canadian Harmonized Sales Tax” in Setup under System Environment.

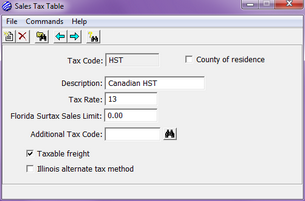

Setting up HST tax location

Set up an HST tax location in the sales tax table with the correct rate. This rate can be updated as needed.

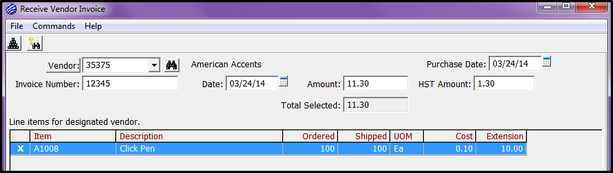

Receive vendor invoice

A distributor is charged HST when they purchase product. Upon receiving the vendor invoice, the total invoice amount, along with the HST amount charged, needs to be entered.

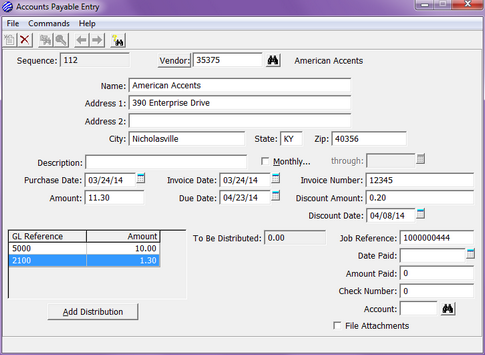

AP Record

Based on the information collected during the “Receive Vendor Invoice” process, the AP record distributes the HST to the sales tax payable account (a debit to that account), decreasing the tax liability.

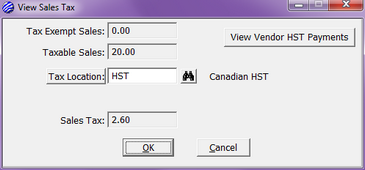

Order Entry > View > Sales Tax

When the distributor invoices the customer, HST is collected based on the higher selling price. The collected HST is credited to the sales tax payable account, increasing the liability. Both amounts can be viewed at any time. The collected amount is shown below. The HST paid by the distributor at the original purchase can be viewed by clicking the “View Vendor HST Payments”.

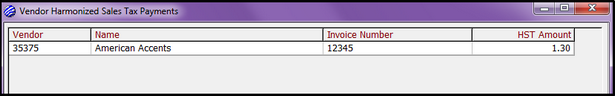

Order Entry > View > Sales Tax > View Vendor HST Payments

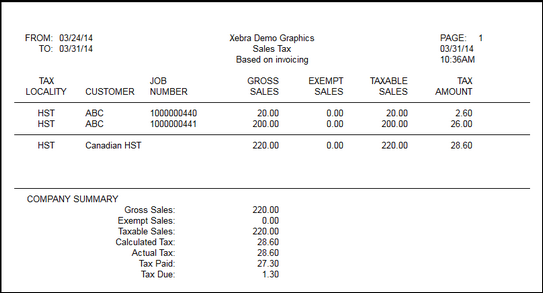

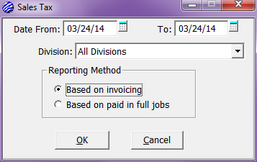

Sales Tax Report Criteria

Sales Tax Report

The Sales Tax Report compiles the sales tax data for a given period. Sales tax collected is detailed, while tax paid is listed in the Summary. Netting the two amounts results in the tax due, and should match the Sales Tax Payable account on the ending date of the report.