Initially, the Collections window prompts you to enter either a number of days or a specific billing customer.

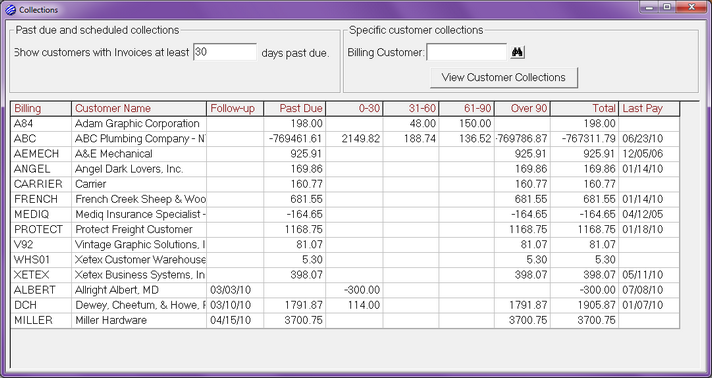

The number of days that you enter controls which customers will be displayed in the list below. If you leave the number of days blank or enter zero and hit the Tab or Enter key on your keyboard, all customers that have any past due invoices will be displayed. If you enter 10 for the number of days, only customers with at least one invoice that is past due by 10 or more days will be displayed. You can enter a higher number for the days past due to reduce the list of customers that need attention to only those that are very late in paying.

In the image below, 30 days past due was entered.

The resulting list is very similar to the Receivable Aging report run with the customer totals only option, but the Collections list does have some columns that don't appear in the Receivable Aging report.

Follow-up is a date that you can set for each customer. In the image above, follow-up dates are set, but when you first start using Xebra Collections, you will not see any. If a follow-up date is set for a customer, the customer would appear in the list whether they have any past due invoices or not. The follow-up date is meant to give you the ability to keep tabs on a customer on a regular basis, regardless of their current payment status.

Past Due is the total amount of invoices that are past due for a customer. The Past Due amount is calculated based on the invoice due date. The number of days that you entered at the top of the Collections window won't affect the Past Due calculations.

Aging, 0-30, 31-60, 61-90, Over 90, is calculated the same way as it is in the Receivable Aging report. Aging is not affected by customer terms or the number of days that you enter at the top of the Collections window. Aging is simply the number of days since the invoice date.

Last Pay is the date that you most recently received a payment from the customer. This gives you an idea at a glance whether the customer is new (if Last Pay is blank) or whether the customer has not paid for anything in a really long time.

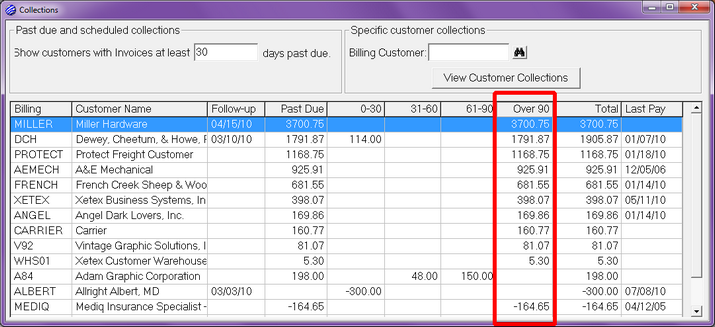

Another feature of the Collections list that sets it apart from the traditional Receivable Aging report is that you can sort the list by any column in the list by clicking on the column heading. Click once to sort in ascending order. Click again to reverse the sort order for the column. The sorting functionality will be particularly useful once you start using the Follow-up date, so that you can find which customers need attention in the order of Follow-up date. The image below shows the list sorted by the Over 90 column. This might come in handy to see which customers have the oldest invoices.

Once you start using the Follow-up date, there might be items in the list with a Follow-up date but no past due amount. In this case, it might be useful to sort by the Past Due column to see which customers have paid since your last collections attempt.