|

We have gone over the tasks of entering and relieving inventory from a PHYSICAL inventory standpoint. Now we must touch on some of the accounting issues related to inventory. It is important to distinguish between the tasks affecting your income and expense accounts versus your asset accounts. The actions of purchasing and selling inventory will not affect the inventory asset account of your "books" on an item-by-item basis. What we refer to as the Operational Task portion of the system tracks the in-flows and out-flows of product in a behind-the-scenes inventory file in order to adjust the inventory asset account with the "Generate Inventory Entry" action noted below.

The Inventory Asset Account will not change with every purchase or sale!

| • | The act of purchasing inventory touches the accounts payable account and an expense account only. |

| • | The Accounts Payable records for purchasing Inventory must be distributed to a cost-of-goods account (an expense account) such as Product Purchased - Inventory -- Never the Inventory Asset account. |

| • | The Enter/Relieve Inventory will increase the quantity and value of the inventory file in the Operational Task portion of the system. |

| • | The act of selling from inventory touches the cash or accounts receivable account and a sales account only. |

| • | Selling from Inventory does not create an Accounts Payable record. |

| • | The cost on the job is for management purposes and does not generate general ledger entries. |

| • | Enter/Relieve Inventory always reduces the Inventory file on a FIFO basis. |

| • | The inventory asset account is updated using automatically generated General Journal entries – usually on a monthly basis. |

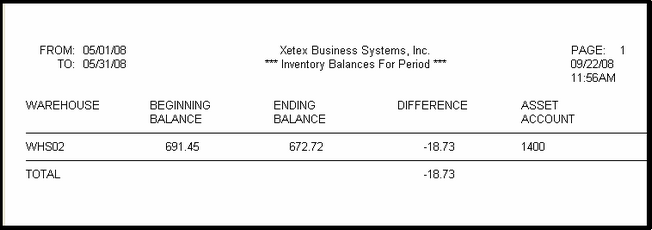

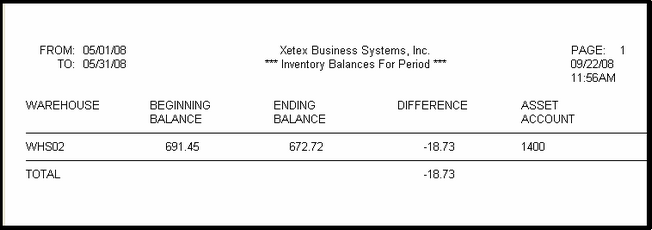

| • | The Generate Inventory Entries action, under the General Journal menu of the Accounting node, first produces a report that compares the beginning and ending inventory balances of the inventory file. This report should be printed and saved from month to month. |

| • | A decreasing inventory balance means that more inventory was sold than purchased. |

| • | An increasing inventory balance means that more inventory was purchased than sold. |

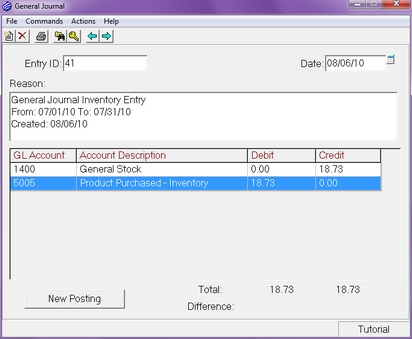

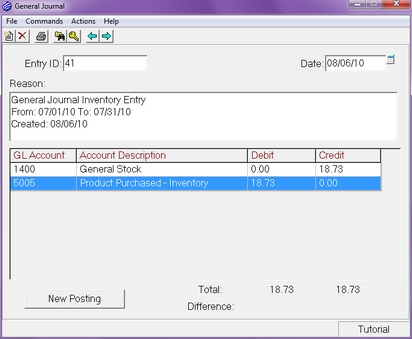

| • | The Xebra will calculate and create the necessary journal entry. From the Accounting node, go to Ledger > General Journal > Actions > Generate Inventory Entries. |

| • | Don’t forget to change the date to the last day of the accounting period. |

| • | In order to reconcile both accounts, the offsetting account for the inventory asset account is always a cost-of-goods account. |

|