This sections illustrates how to enter an accounts payable for an overhead expense that is not job related.

Go through the following exercise to enter an overhead expense.

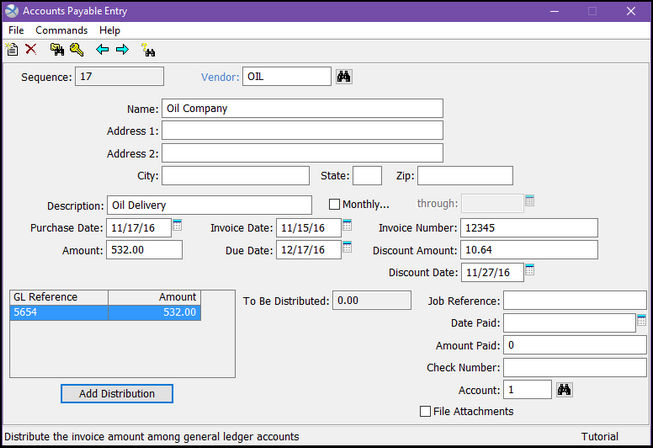

Select Commands > New from the AP Entry menu.

Enter OIL<Tab> for the Vendor.

Say YES to Create New and enter Oil Company as the name on the Vendor Ordering dialog. Tab through the remaining fields and create a vendor remittance code as well. Enter 5555 for the account number and tab to the Terms field. Select 2% 10 days Net 30 for the payment terms from this vendor. Close the Vendor Ordering and Remittance dialogs to return to Accounts Payable Entry.

For Description, enter Oil Delivery.

Press <Tab> to accept the current date for the Purchase Date.

For the Invoice Date, enter a date a few days before your current system date (ex. -2<TAB>).

Enter 12345<Tab> for the Invoice Number.

Enter 532.00<Tab> for the amount.

Since we entered the payment terms in the vendor remittance file, the due date is automatically populated. Alternatively, for the Due Date, enter +30<Tab> to give a date 30 days from the purchase date.

Notice the $10.64 in the Discount Amount, which represents 2% of the total amount.

Enter +10<Tab> for the Discount Date or accept the automatically calculated date.

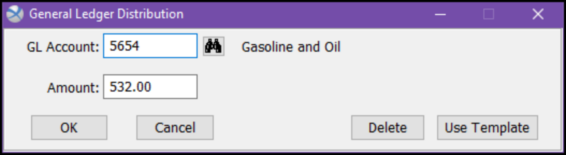

<Tab> through the Job Reference. The General Ledger Distribution window appears.

Enter 5654 for the GL Account or search for Gasoline and Oil in the list.

Enter the Amount from the invoice.

Notice that the To Be Distributed amount is now $0.00.

Go through the next exercise to enter a monthly expense.

Select Commands > New from the AP Entry menu.

Enter STATEF<Tab> for the Vendor.

For Description, enter Premium Payment.

Click the Monthly check box to indicate that this is a monthly payment. Enter 12/31 in the through: prompt. This record will now automatically duplicate itself when it is paid, and will advance its due date by one month.

Press <Tab> to accept the current date for the Purchase Date.

For the Invoice Date, enter a date a few days before your current system date (ex. -2<TAB>).

Enter 6108567222<Tab> for the Invoice Number.

Enter 237.50<Tab> for the amount.

<Tab> through the Job Reference. The General Ledger Distribution window appears.

All of our payments to State Farm Insurance fit in the category of insurance expenses. When the vendor record for State Farm Insurance was created, we entered 5750, our insurance expense account, as the GL Reference. That account number now appears as the default for our distribution of this bill. Press <Tab> to accept this default account.

Enter 237.50<Tab> for the Amount to be distributed to Insurance Expense. Close the General Ledger Distribution dialog box.

If you would like to save a copy of the invoice directly to this AP record, click on the File Attachments checkbox in the bottom, left-hand corner of the screen, and attach the image file.

Our AP Entry is complete. Close the Accounts Payable Entry window.

![]()