Each “Checkbook” is used for tracking Corporate Financial Accounts. In addition to tracking your Corporate Checking Accounts, separate Checkbooks can be set up to track Savings Accounts, Credit Cards, and Lines of Credit.

Before setting up any financial accounts, make sure that you have a GL Account set up for each individual account. Refer to the previous section, Using the Chart of Accounts.

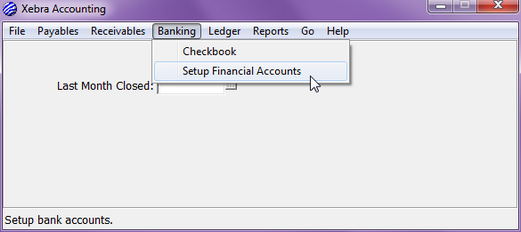

GO > Accounting > Banking > Setup Checking Accounts

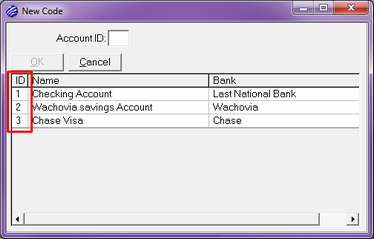

Commands > New

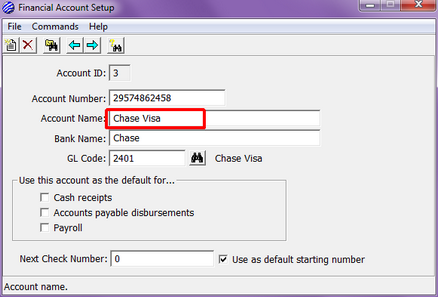

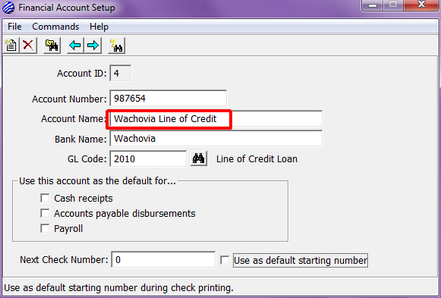

Each account will have its own unique Account ID

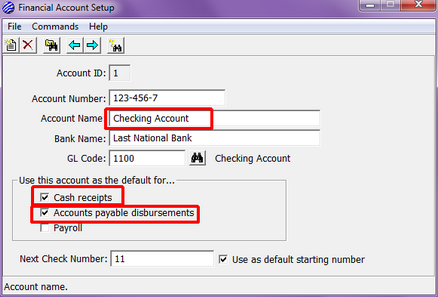

Enter the account number, account name, bank name, corresponding GL code, and the starting check number.

This financial account is the one we will be receiving our customers' payments into, so we have chosen it to be the þ Cash receipts default account. This is also the account we will be paying our bills with, so we have chosen it to be the þ Accounts payable disbursements default account.

More information on managing your checking account is found throughout the Bookkeeping section of this manual.

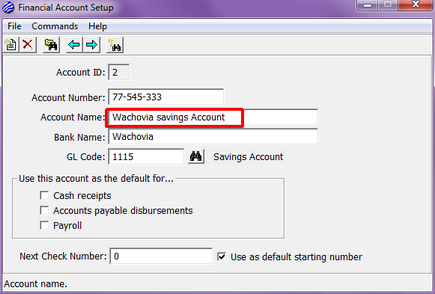

PLEASE NOTE: The next 3 examples represent accounts from which you typically do not write checks. Therefore, the Next Check Number field and Use as default starting number checkbox are not used. Transactions within these accounts should be given a check number manually. We recommend you choose unique numbers that do not interfere with or overlap with your checking account. DO NOT USE 0 as a check number.

Savings Account example:

Credit Card Account example:

For more information on managing your credit cards, please see the Paying Vendors with Credit Cards section in Bookkeeping.

Line of Credit example:

For more information, please see the Line-Of-Credit Account section in Bookkeeping.