XETEX Xebra uses 14 accounting periods for each year. They are:

| 1) | 1 Beginning Balance Period that holds the starting balances for each year. |

| 2) | 12 accounting periods, one for each month of the year. |

| 3) | 1 Year End Adjustments Period for adding adjustments for taxes, depreciation expense, and other reclassifications. These adjustments are usually provided by the accountant when tax returns are prepared. |

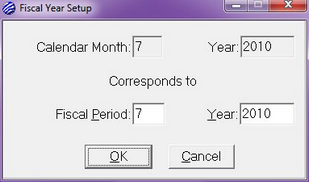

Within the general ledger, the monthly accounting periods are numbered 1 through 12 to represent the fiscal accounting period. The general ledger is the only place where operators will deal with fiscal accounting periods. Everywhere else in the system operators work only with the calendar month and year. If you are on a calendar fiscal year, there is no setup required. If you are on anything other than a calendar year, you must go to Setup>Options>FiscalYear. The setup screen shows the current month and asks you for the corresponding fiscal month and year. The example shows a calendar accounting year. If your fiscal year ends on June 30, then the fiscal period that corresponds to July is fiscal period 1.

If you are not using the calendar year for your fiscal year, you should make this change before you start importing data into the general ledger.

The Beginning Balance Period

The second year that you use XETEX Xebra, the beginning balance period will be created when you close the prior year. The first year, you must create the beginning balance period manually. This is accomplished by creating a balanced set of G/L transactions that reflect the ending balances as of the date you stopped using your prior system. Your accountant will be able to help you with this.

If you are starting with XETEX at the beginning of your fiscal year, your beginning balances would include only Asset, Liability, and Equity Accounts.

There is no problem starting with XETEX Xebra in the middle of an accounting year. The only difference is that the beginning balance period will need to include Revenue and Expense accounts.

If you are running cash basis accounting, you will have to create separate beginning balances for the cash basis general ledger. When you select Accounting>Ledger, you will have the option to select either accrual basis or cash basis accounting. From that point on, they are completely separate except that they use the same chart of accounts. Cash basis accounting will not use some accounts (i.e. Accounts Receivable & Accounts Payable). Accrual basis accounting will not use the revenue account designated for Deposits & Partial Payments.

Conditional Financial Reports

At the request of our customers, we have provided the ability to run financial reports midmonth without having to go through the month-end close procedures. As a result, too many of our customers are not doing the month-end procedures regularly. Every January and February, we get calls from customers who are trying to close out January of the previous year. Errors made a year ago are much harder to find and correct.

The Month-End Closing procedure is a critical, error-checking process that should be performed on a monthly basis. Running a Balance Sheet is not a suitable substitute for doing this.

Month–End Procedures MUST be done EVERY MONTH!