|

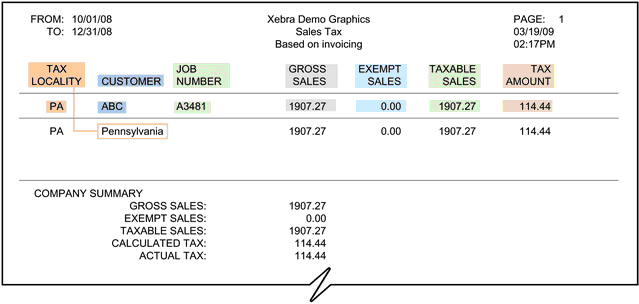

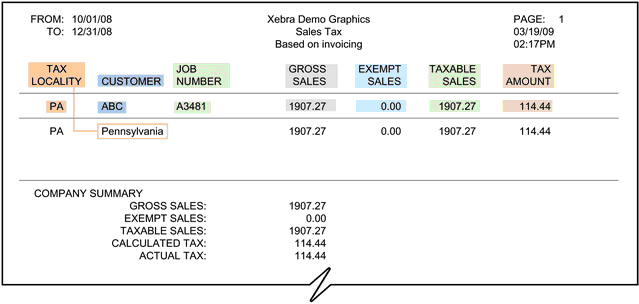

This report is used to pay sales tax to the collection authorities, based on sales for the specified date range. It will break each transaction into taxable and tax exempt portions and provide a summary of reasons for the exemptions.

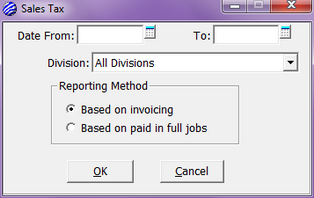

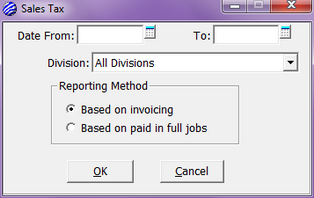

| o | Blank - it is not recommended that you leave both date fields blank. This may result in a "blank" or inaccurate report. |

| o | To: Date only - this will show you everything from the beginning up to the specified date. |

| o | Both - this will show you results for the specified date range. |

| • | Division - Only visible if you are set up for Divisional Accounting. You may run this report by all divisions, or you can run it for an individual division. |

| • | Reporting Method - Select the reporting method for the report. |

| o | Based on invoicing - When flagged, sales will include jobs that have been invoiced. |

| o | Based on paid in full jobs - When flagged, sales will only include jobs that have been paid in full. |

|