|

The issue of sales tax may also result in a credit job being created. If sales tax was erroneously charged on a job, a Sales Tax Reversal will be necessary.

First, find the job that was incorrectly charged sales tax.

If the job has NOT been Paid in Full:

| • | While viewing the job in the Order Entry dialog, select Actions > Sales Tax Reversal. |

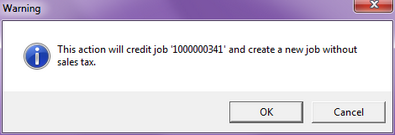

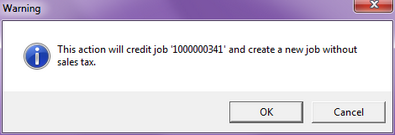

| • | A Warning dialog will explain that the selected job will be credited and a new job created with no sales tax. |

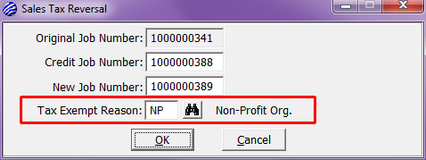

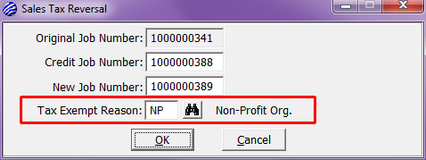

| • | The Sales Tax Reversal dialog details the Original Job Number, and the newly created Credit Job Number and New Job Number. You will be required to enter a Tax Exempt Reason. |

| • | Select OK to create a Credit Job and a New Job without sales tax. If you view the Original Job or the Credit Job, you will notice that they are both marked Paid-in-full. |

If the job has been Paid in Full, the reversal will have to be done manually:

| • | If you have already changed your customer to Tax Exempt status, you will need to change it back for this first part. |

| • | While viewing the job in the Order Entry dialog, select Actions > Credit Job. |

| • | Invoice the Credit Job using today's date. |

| • | Go to View > Customer > Billing, and flag your customer as Tax Exempt. |

| • | Go back to the original job and select Commands > Repeat Job. |

| • | Invoice the Repeat Job, making sure that tax was not charged. |

| • | GO > Accounting > Receivables > Cash Receipts > New Check. |

| • | Enter your customer code. |

| • | You can make up a check number. |

| • | Do not enter a Check Amount. Leave it blank. |

| • | Click on New, and enter either the job number or invoice number for the Repeat Job. |

| • | Enter a positive payment for the full amount of the invoice. |

| • | Click on New, and ether either the job number or invoice number for the Credit Job. |

| • | Enter a negative payment for the full amount of the Repeat Job's invoice (total minus the tax). |

| • | The balance left on the Credit Job will now be the same as the tax amount on the original invoice (but it will be a negative). You can do one of three things: |

| ► | Apply the overpayment to an open job |

| ► | Keep the Credit Job open to apply the overpayment to a future job |

| ► | Issue a refund to your customer |

|