Overview

The parts of the Xebra relating to Credit Management were designed to help you avoid placing orders to vendors for customers that have not paid for their previous orders. The Xebra does this by allowing you to define some simple rules for determining when an invoice is too far past due, letting you modify these rules on a per customer basis if some of your customers deserve special consideration, and setting flags By Job, By Customer, and By Release that alert order entry operators that there is a credit problem.

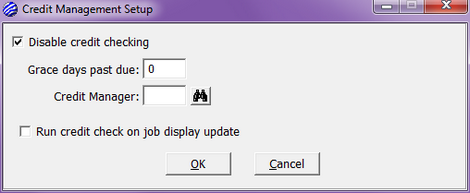

Initial Setup: GO > Setup > Options > Credit Management Setup

| • | Disable Credit Checking - turns off credit checking for all customers in Xebra. |

| • | Grace Days Past Due – The number of days past due that an invoice can be before credit checking flags the customer for credit caution and places any new jobs for the customer on credit hold. |

| • | Credit Manager – If this field is blank, all operators with accounting privileges can access the Credit Management menu items in the accounting node and the customer billing window. Place an operator code in this field if your company designates one person to handle credit management. In this case, only the credit manager will have access to the credit management functions. The credit manager will also receive messages each time credit management places a job on hold. |

| • | Run credit check on job display update - If this check box is checked, credit checking will take place every time the display of a job in Order Entry is updated. The purpose of this is to allow over limit detection when changes to an existing job exceed a customers credit limit. |

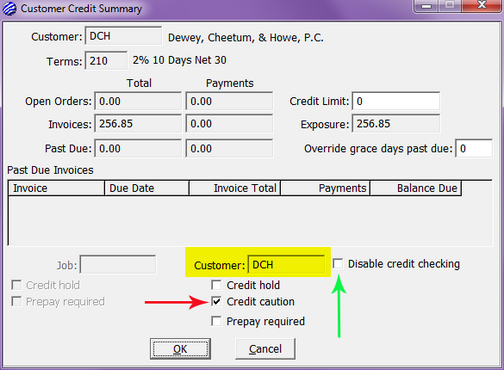

To set up a Customer in Credit Management: GO > Accounting > Receivables > Credit Management > By Customer > Commands > Set Customer Credit Status > Enter Customer # > Customer Credit Summary Dialog box

This is the Customer Credit Summary Dialog - this is displayed from the Credit Management by Job dialog, the Credit Management by Customer dialog, the Credit Management by Release dialog, or the customer billing window under Options. If you select a credit manager in the Credit Management Setup dialog, only the credit manager will have access to the Customer Credit Summary. If you don't select a credit manager, all operators with accounting privileges will be able to open this window.

| • | Disable Credit Checking - turns off credit checking for an individual customer if this is flagged. Credit checking can be turned off for all customers by disabling it in the Credit Management Setup dialog as shown above. |

| • | Credit Hold - If this flag is set when the operator selects the OK button on the New Job dialog, the new job is placed on hold and the operator will see a message box that says, "Customer (billing code) (billing name) is on credit hold." After closing the warning message box, the operator can continue the initial job entry as normal. If the credit hold flag is set, and an operator tries to Create Vendor Purchase Order for the customer, the operator will be blocked from generating the purchase order. The operator will see a message box that reads, "This job is in credit hold status. Your credit manager will have to clear this hold status before purchase orders can be produced for this job." Whenever the Xebra places a job on hold because the customer is on hold, your credit manager will get an operator message that reads "Job (job number) was placed on hold because customer (billing code) (billing name) is on credit hold." Nobody will get an operator message if you don't have an operator designated as the Credit Manager. |

Note: In Customer Specific Inventory, operators are able to enter a transfer; however, they are blocked from printing the Release Documents when the customer is on Credit Hold.

| • | Credit caution - The Xebra will set this flag during new job creation if the customer fails the credit check. The purpose of this flag is to alert your credit manager that the customer has a credit problem that requires attention without placing the customer on credit hold. The system won't automatically put a customer on credit hold. It is up to an operator to decide what to do about the caution. If the credit caution flag was set by a previous job entry but the credit check reveals no credit problem at present, the credit caution flag will be cleared by the system. |

| • | Prepay Required - If this flag is set during new job entry, and the credit hold flag is not also set, the prepay required flag on the new job is set and the operator is warned by a message box, "Customer (billing code) (billing name) is required to make prepayments." Whenever the Xebra sets the prepay required flag on a job because the prepay required flag is set on the customer, your credit manager will get an operator message that reads "Job (job number) was placed on hold because customer (billing code) (billing name) must make prepayments." Nobody will get an operator message if you don't have an operator designated as the credit manager. |

Note: Most of the prompts and the list on this screen are read-only. The two fields that you can modify are:

| • | Credit Limit - The total of the open orders and invoices for the customer that is allowed before credit checking will place the customer on caution and jobs on hold. A zero credit limit is treated as unlimited credit and the customer will never fail a credit check because they are over their limit. |

| • | Override Grace Days Past Due - If the value in this field is not zero, it overrides the value set for grace days in the Credit Management Setup dialog. Grace days past due are the number of days past due that an invoice can be before credit checking flags the customer for credit caution and places the new job for the customer on credit hold |

To View Current Credit Management Settings: GO > Accounting > Receivables > Credit Management > By Customer, By Job, or By Release

| • | Credit Management by Customer - lists customers that have been flagged for special credit considerations. Double-click on an item in the list to display the Customer Credit Summary for the customer. |

| • | Credit Management by Job - lists jobs that have been flagged for special credit considerations. Double-click on an item in the list to display the Customer Credit Summary for the job. |

| • | Credit Management by Release - lists releases that have been flagged for special credit considerations. Double-click on an item in the list to display the Customer Credit Summary for the job. |

The following is a list of flags that pertain to Credit Management:

Job Flags - These will appear upon creating a new job if the Customer is on Credit Hold or Prepay Required:

| • | "CREDIT HOLD" displays next to the job number on the order entry window. This will also appear if the customer fails the credit check. If the customer fails the credit check, one of three message boxes is displayed to the operator depending on the situation: |

| 1. | "Customer (billing code) (billing name) failed the credit check because of past due invoices." |

| 2. | "Customer (billing code) (billing name) failed the credit check because their credit limit has been exceeded." |

| 3. | "Customer (billing code) (billing name) failed the credit check because their credit limit has been exceeded and because of past due invoices." |

| • | "PREPAYMENT REQUIRED" displays next to the job number on the order entry window. The operator will also be blocked from generating a vendor purchase order and will receive a message box that reads, "This job is in credit hold status. Your credit manager will have to clear this hold status before purchase orders can be produced for this job." |

Credit Checking

A small but important part of the Credit Management features is Credit Checking. It occurs during new job entry after the operator presses the OK button on the New Job dialog. Credit checking only occurs if the various credit status flags on the customer billing record don't already place the job on hold or flag it for prepayment required. During credit checking, the Xebra calculates the credit exposure (credit exposure=balance of open invoices + balance of open orders) for the customer and determines whether the customer has any past due invoices. If the credit exposure is greater than or equal to the customer's credit limit, or the customer has one or more past due invoices, the customer fails the credit check and the hold flags are set. If you disable credit checking through the Credit Management Setup dialog or the Customer Credit Summary dialog, the credit status flags on jobs or customers remain set. No flags are cleared by disabling credit checking.

To Edit Current Credit Management Settings:

GO > Accounting > Receivables > Credit Management > By Customer, By Job, or By Release

| • | Credit Management by Customer – use this selection if you want the changes to affect all jobs and all releases pertaining to a particular customer. Double-click on a customer in the list to display the Customer Credit Summary for the customer. Select or de-select the desired checkboxes by clicking on them. When you are done, click OK. |

| • | Credit Management by Job – use this selection if you only want the changes to affect a particular job without changing the overall customer’s settings. Double-click on a job in the list to display the Customer Credit Summary for the job. Select or de-select the desired checkboxes by clicking on them. When you are done, click OK. |

| • | Credit Management by Release - use this selection if you only want the changes to affect a particular release without changing the overall customer’s settings. Double-click on a release in the list to display the Customer Credit Summary for the release. Select or de-select the desired checkboxes by clicking on them. When you are done, click OK. |